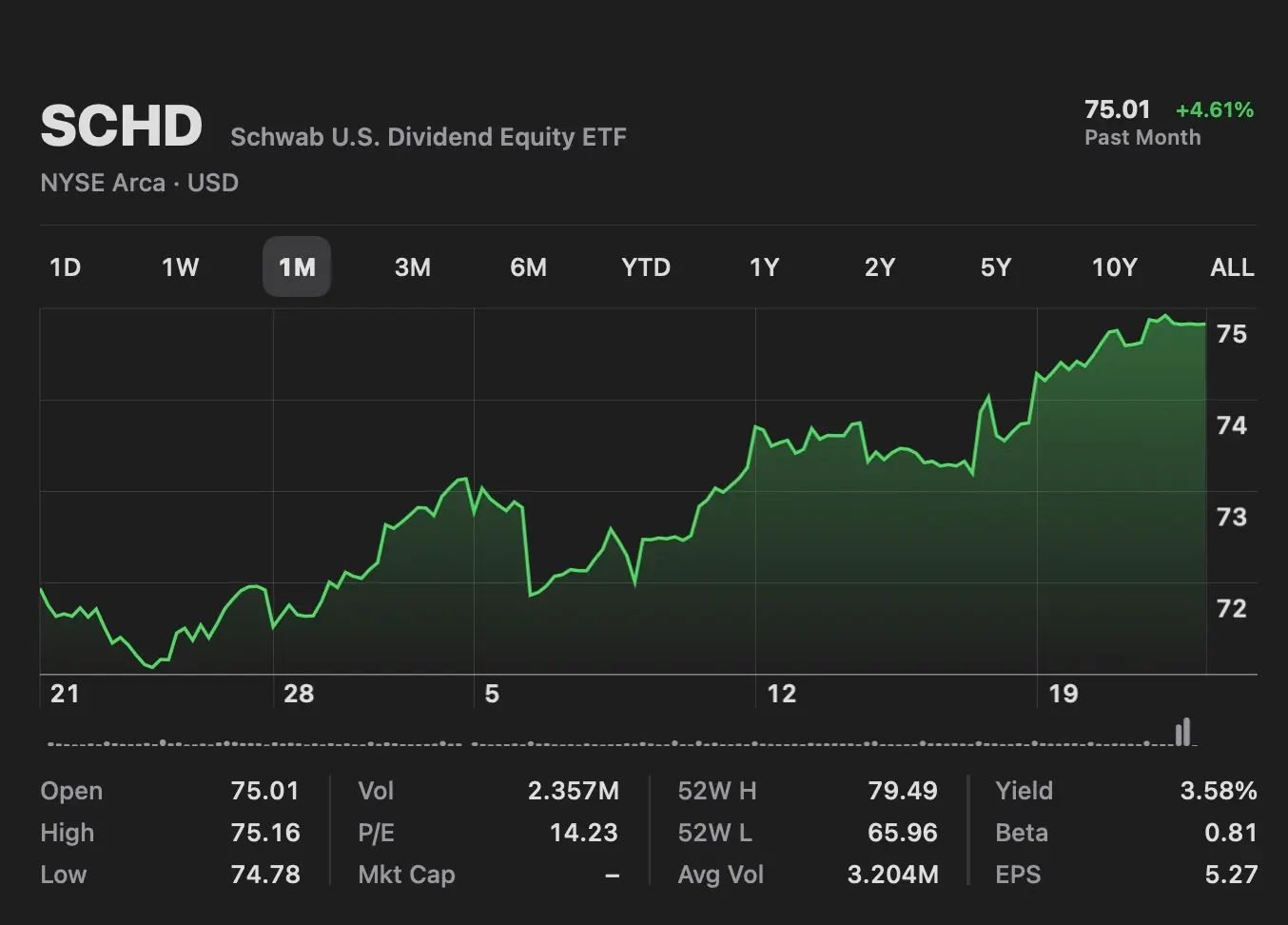

Although primarily focused on growth investments, I contribute monthly to the Schwab U.S. Dividend Equity ETF™ (SCHD) to diversify my Fidelity brokerage account portfolio. This exchange-traded fund (ETF) focuses on high-quality, dividend-paying U.S. stocks and has a net/gross expense ratio of 0.06%. Here are some of the reasons I’m investing in this fund:

- Tax-Efficient Dividend Growth: SCHD is designed to track the performance of companies with a history of consistent dividend payments and strong fundamentals. Dividends from qualified U.S. corporations are taxed similar to long-term capital gains, which will be beneficial if I choose to use dividends as an income stream. For now, I reinvest dividends into the ETF – a practice called DRIP.

- Lower Taxable Events: SCHD’s investment strategy tends to result in lower portfolio turnover than actively managed funds. Lower turnover means fewer taxable events, such as capital gains distributions, which can reduce tax liabilities for investors.

- Potential for Long-Term Capital Appreciation: SCHD emphasizes dividend-paying stocks and seeks companies with strong growth potential. This balanced approach may lead to capital appreciation over the long term, offering investors the opportunity for both dividend income and potential capital gains.

- Risk Mitigation through Dividend Aristocrats: SCHD includes companies with a consistent history of paying and increasing dividends over time. Many of these companies are considered Dividend Aristocrats, known for their stability and financial strength. Investing in such companies can help mitigate risk during market downturns.

- Potential for Tax-Loss Harvesting: In a taxable account, investors can use tax-loss harvesting strategies to offset capital gains taxes by selling investments that have decreased in value. Holding SCHD in combination with other assets may offer opportunities for tax-efficient portfolio rebalancing.

Despite the benefits of holding SCHD in a taxable account, it’s essential to remember that individual financial situations vary, and tax considerations should not be the sole factor in investment decisions.

Do you invest in dividend funds? Drop me a comment below with your thoughts!

Hi Rishi, I’m very new to investing. A struggling musician barely scraping by for 20 years. Lost everything during covid, got a real job and have finally gotten to a place to start investing. I have a lot of interest in SCHD, been looking at a bunch of funds, but it seems to be the one im going to buy. I saw an article on taxes being complicated with these funds, which lead me to your article. I’m intending to use the DRIP, very much a set it, add to it, and forget it. And as long as I don’t sell any shares and reinvest dividends I shouldn’t have anything to worry about at tax time? Sorry for the lengthy comment, I have no idea what I’m doing. You’re article helped I think

Hey Joseph! Thanks for your comment!

I’m admittedly no expert with these things and spend an unhealthy amount of time watching YouTube videos, talking to “experts”, and reading through /r/personalfinance on Reddit to learn more.

I don’t put too much into SCHD right now as the bulk of my net worth is in growth index funds like VTI and VXUS for domestic and international/emerging markets, respectively. Although SCHD produces quarterly, qualified dividends, you would need to consider your actual income to determine the tax (if any) you would pay. The benefit of DRIP is primarily for compounding over time.

I’m a firm dollar-cost averaging investor. Each week, I invest in VTI and VXUS, regardless of the market, and let statistics do the work. Remember, time in the market >>> timing the market.