This post was updated in January 2024 based on the limits for 2024. The maximum contribution, MAGI, etc. may change year-to-year.

A Roth individual retirement account (IRA) is a retirement account allowing annual contributions of up to $7,000 (or $7,500 for those over 50) at the time of this writing. Contributions are made with post-tax funds, which can be invested in individual stocks, REITs, index funds, etc. Withdrawals after age 59 1/2 are tax-free on capital gains, leveraging the benefit of long-term compounding.

There are limits on Roth IRA contributions based on one’s modified adjusted gross income (MAGI). For example, in 2023, a single individual with a MAGI > $153,000 could not contribute anything to a Roth IRA traditionally. Enter the backdoor contribution.

Here, I outline how I perform this task through Fidelity. Fair warning – I’m not a tax or financial expert. These steps may need to be altered depending on your specific circumstances.

Traditional IRA Contribution

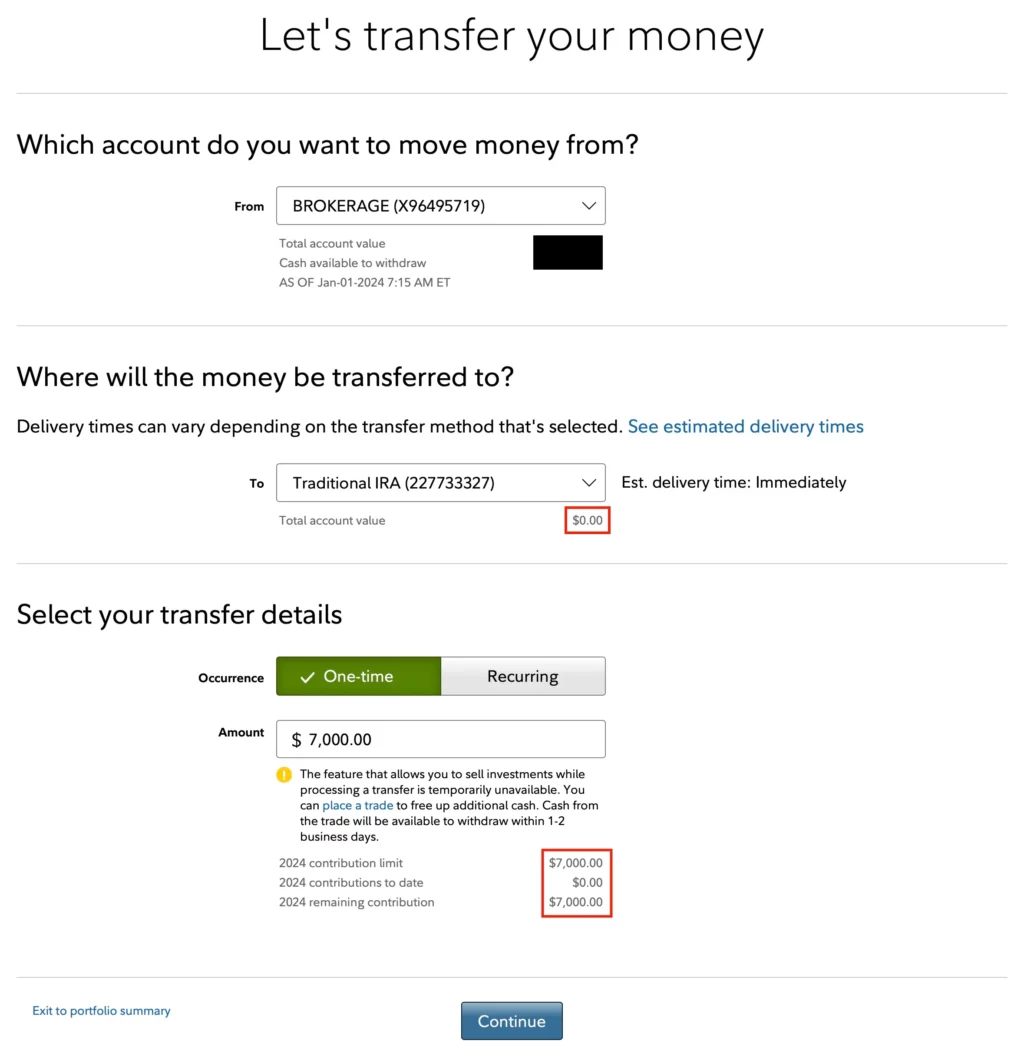

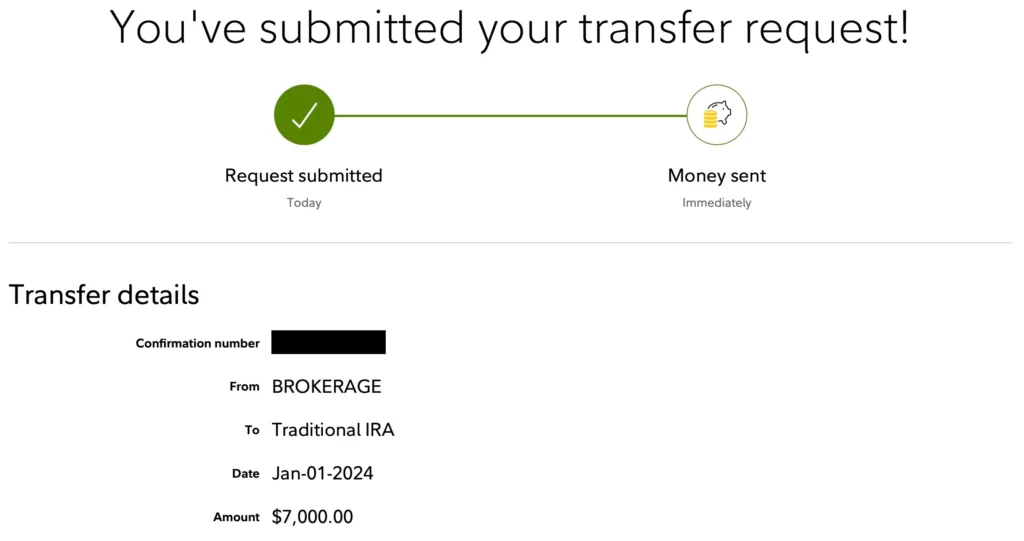

Within Fidelity, I have several accounts, including a traditional IRA and a Roth IRA. Each January, I transfer the maximum allowed contribution to my traditional IRA from my brokerage account or linked checking account. I leave these contributions as cash (typically a money market).

One can contribute to the previous year’s traditional IRA until April 15th of the current year. For instance, contributions in January 2024 can count for either 2023 or 2024. To simplify tax forms, I apply January contributions to the current year. In other words, my January 2024 contribution is for 2024.

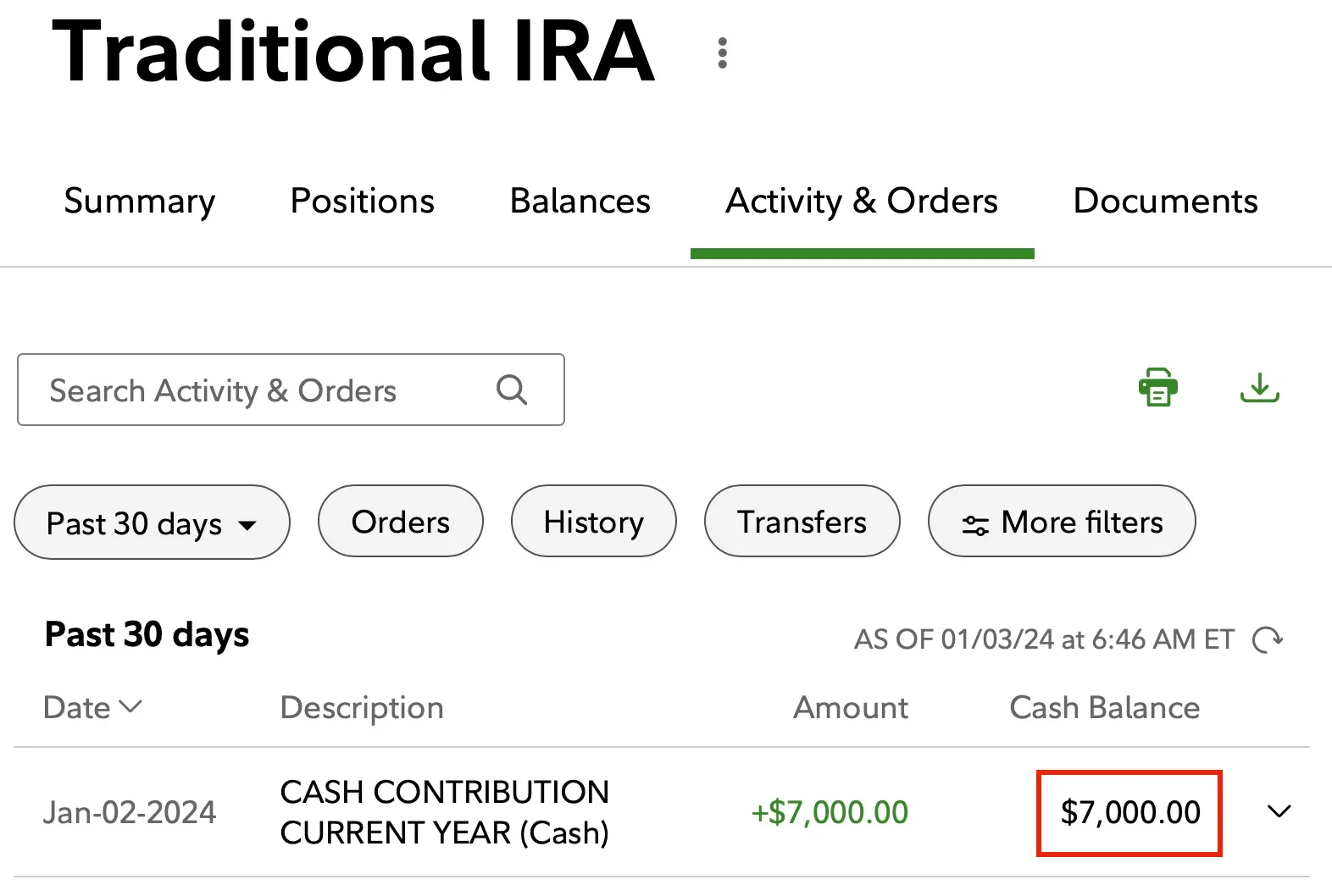

It takes a few business days for funds to settle. Go to the Traditional IRA and click the Activity & Orders tab to check. If “cash balance” indicates “processing,” the funds haven’t settled. Wait until it displays your full balance, as shown below in red, before proceeding.

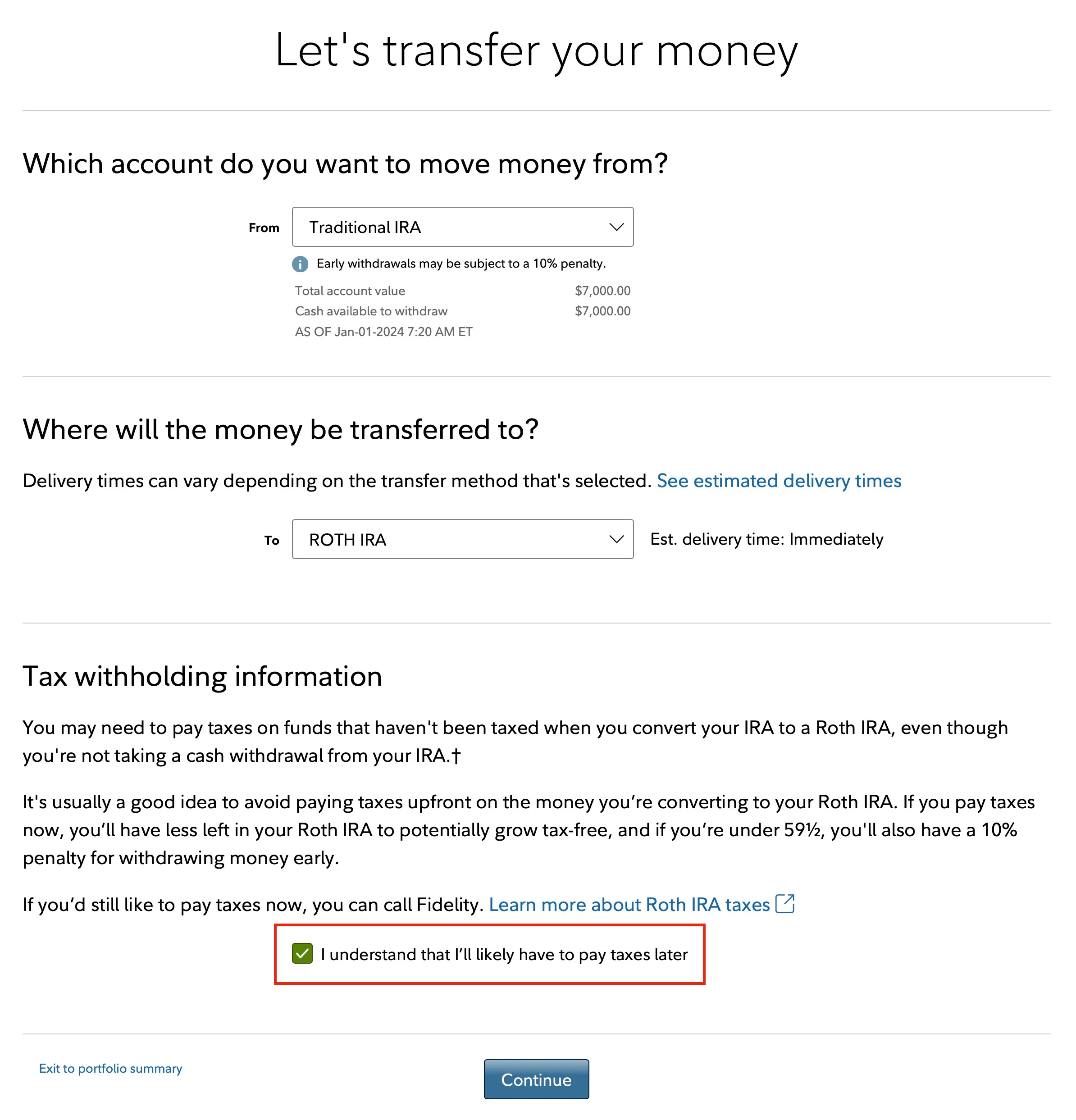

Roth Conversion

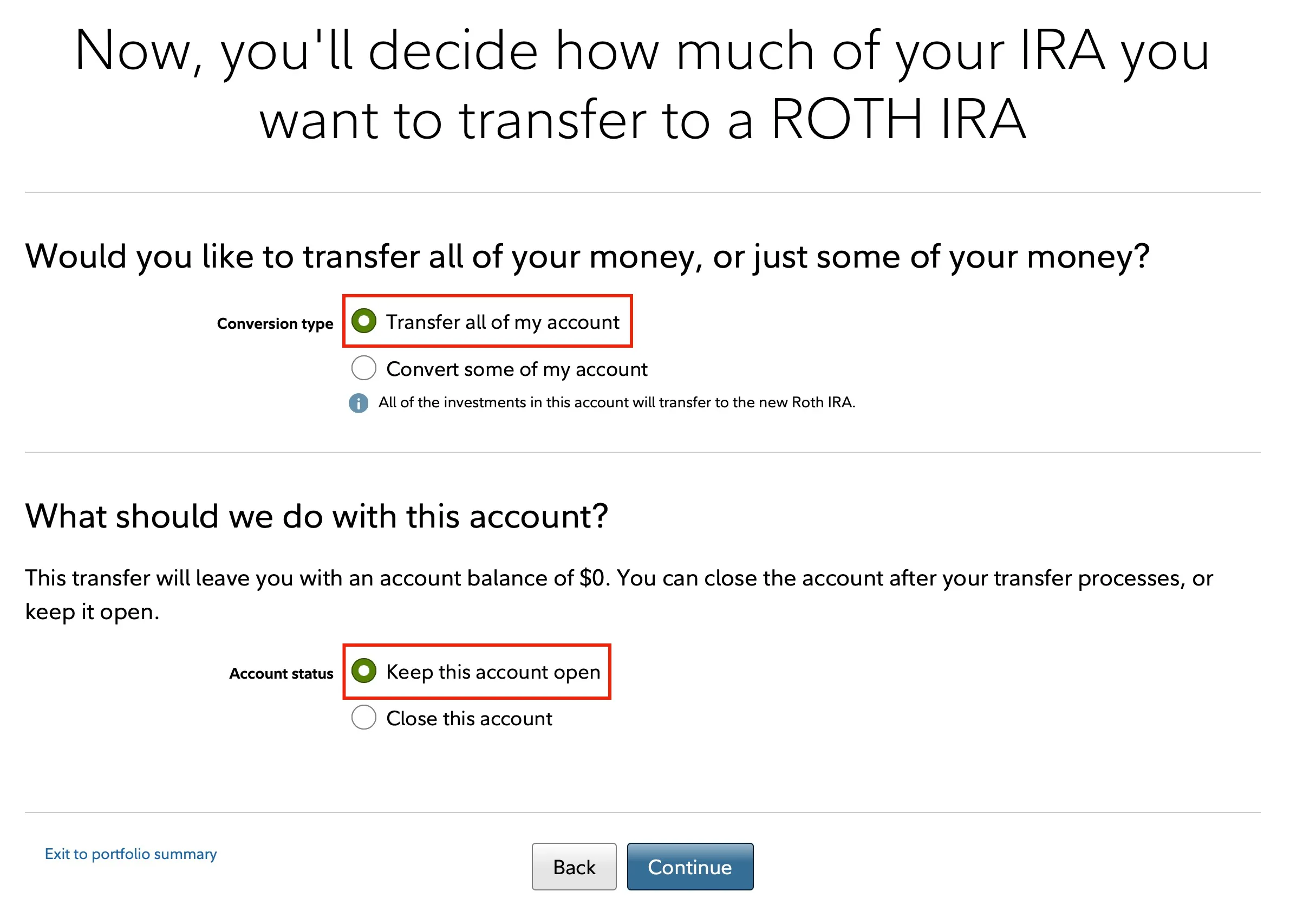

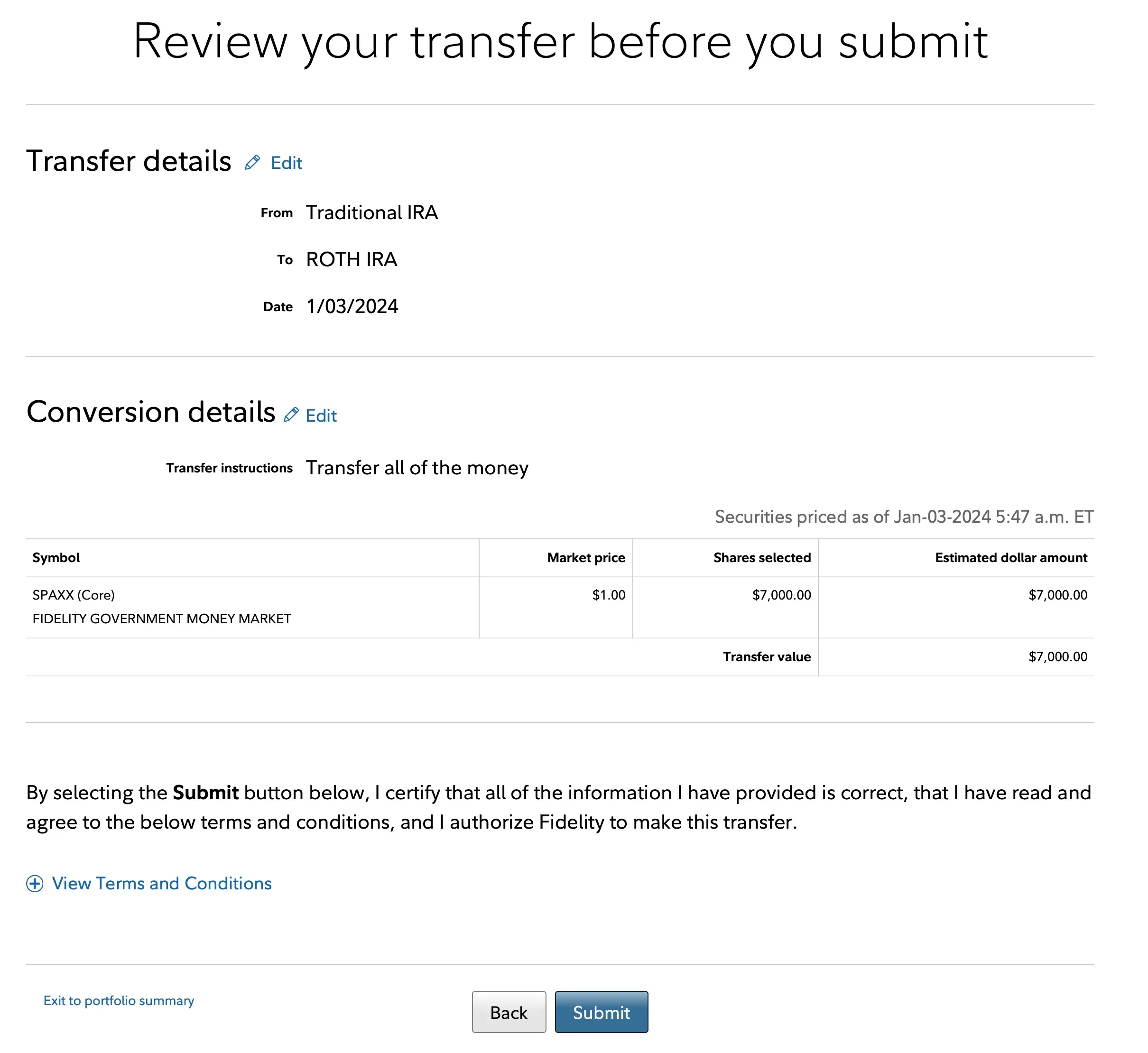

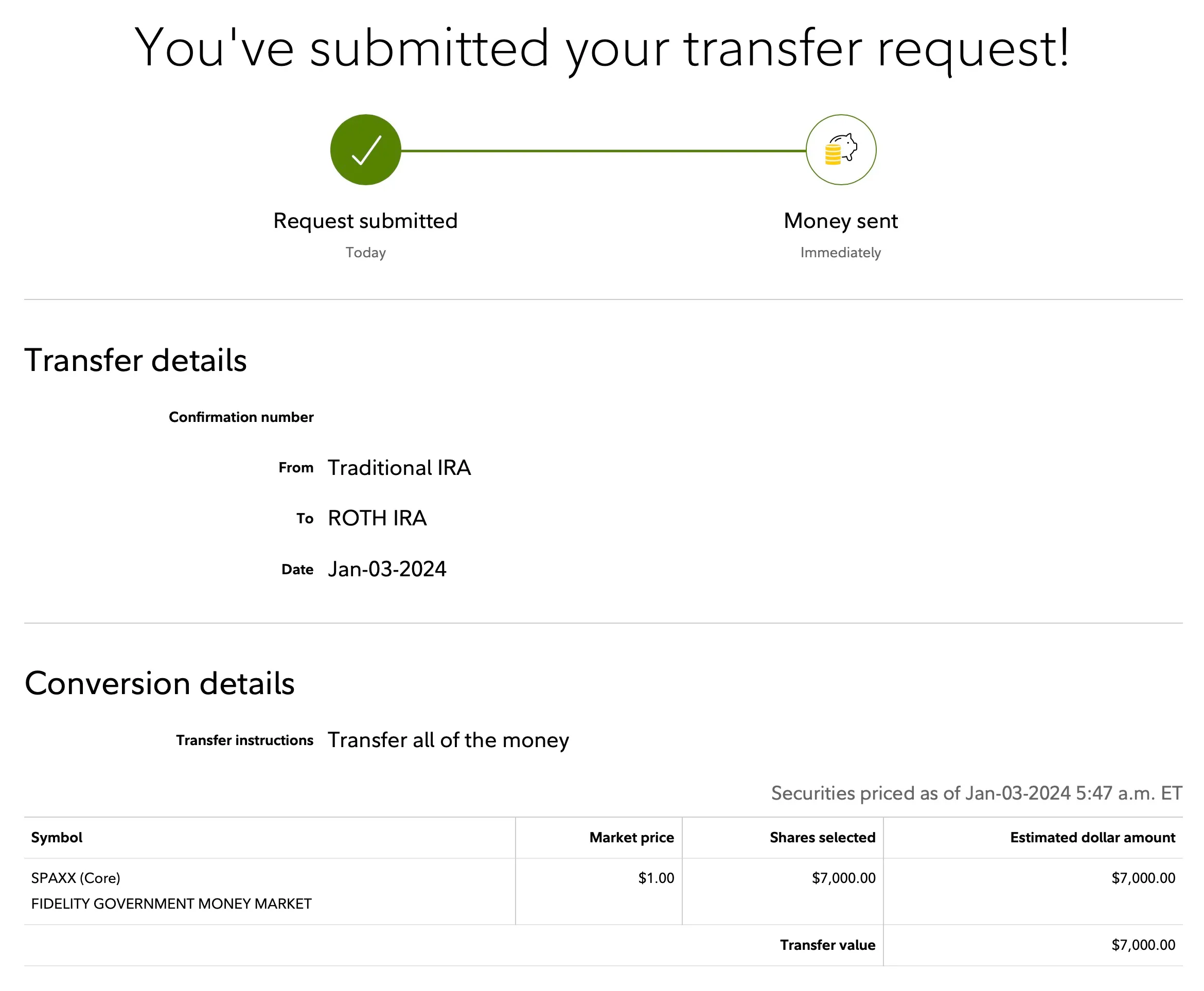

Use the “Transfer” option on Fidelity’s page to roll over Traditional IRA funds into your Roth IRA as a conversion.

Convert the full amount from the traditional IRA to the Roth IRA annually, ensuring the traditional IRA balance is $0 throughout the year, except during the brief 1-3 days of Roth conversion. Keep the traditional IRA open for future backdoor Roth contributions.

Invest Roth Funds

Once the funds have settled in the Roth IRA, I’ll invest in exchange-traded funds (ETFs) like Vanguard’s Total Stock Market ETF (VTI, 0.03% expense ratio, represents the United States’ total stock market) and Vanguard Total International Stock ETF (VXUS, 0.07% expense ratio, represents the international market). This process is outside the scope of this article. Please don’t forget to invest your funds!

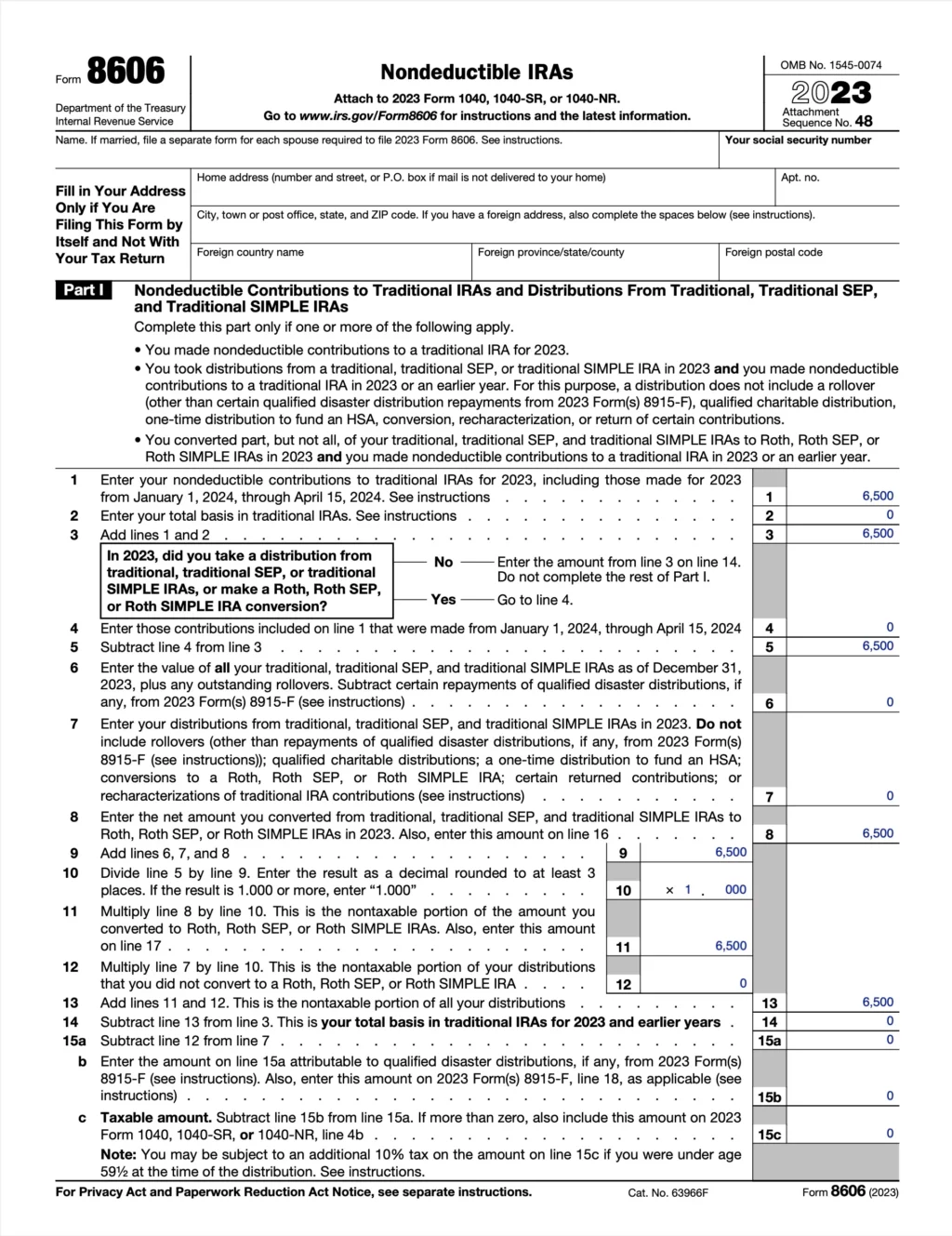

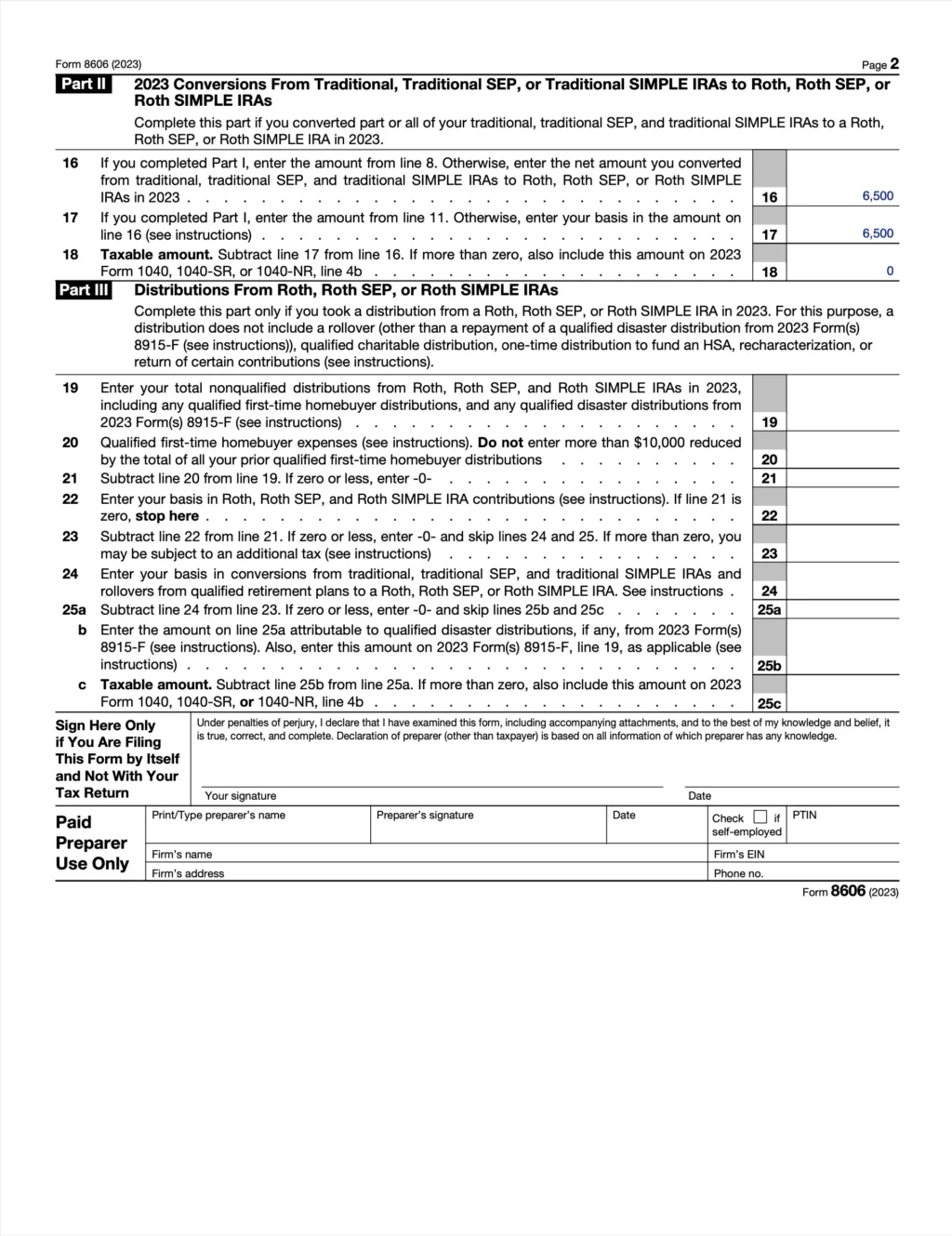

IRS Form 8606

I complete IRS form 8606 for nondeductible IRAs every year, with the only variation being the contribution amount, which I adjust to match the annual maximum. Here’s an example of my 2023 form when the Roth limit was $6,500. In 2024, I’ll change all instances of “6,500” to “7,000” to align with the increased contribution limit.

It’s easier to do the contribution and conversion in the same calendar year as the taxes. In other words, if I try to contribute to my 2023 taxes by going through the aforementioned process in January 2024, my 8606 tax form becomes a little more complicated. Instead, I complete the contribution AND conversion process in January as part of my yearly tasks – membership/subscription renewals, looking for competitive rates on utilities, rebalancing my portfolio, etc.

Drop me a comment below with your questions and experiences regarding Roth IRAs!

Thank you for this wonderful article, I’ve returned back to this post at least 3 times now! I have never filed out the 8606 form before and I’ve used the backdoor method for the past 3 years. What do I do? I’ve already filled my taxes for this year too! Will I get in trouble? Should I retroactively fill it?

Thank you

Yes – absolutely retroactively fill out form 8606 (using a tax consultant if necessary) to avoid paying taxes on capital gains later in life.

Thank you for writing this article! So insightful! Do you, by any chance, know if a married couple that is living together but filing taxes separately, is qualified to do a backdoor Roth? I have read that they are not qualified for a Roth IRA but wondering if backdoor Roth is still an option?

Yes you can, but each individual needs to fill out their own IRS Form 8606. Read more here.

Aren’t the fees higher for investing in Vanguards funds through the fidelity platform? Also great post but one thing to be aware of if you have previous IRAs from previous jobs that have any money in them you are subject to the pro rata rule. To be able to do the back door Roth and not be subject to that rule you need to have all IRA accounts have 0$ in them on 12/31 the year you are claiming the conversion.

I think the fees apply for mutual funds but not ETFs through Vanguard. And good point about the pro rata rule. Since the backdoor Roth conversion essentially involves withdrawing money from a traditional IRA, the pro rata rule applies (but in my case, 100% of the traditional IRA is composed of after-tax, non-deductible funds).

As you mentioned and for those who are interested, it only becomes dicey if the traditional IRA has both pre and post-tax contributions. You don’t get to direct only the post-tax dollars to the Roth IRA. Instead, the pro rata rule states that the taxes on your Roth conversion will be calculated based on the proportional amounts of your pre-tax and after-tax contributions.

Interesting you invest in Vanguard funds and not fidelity funds

I like their ETFs and expense ratios. 🤷🏽♂️