With market volatility, unexpected layoffs, personal emergencies, and uncertainty about the future, the COVID pandemic taught us the value of establishing an emergency fund. Let’s discuss how I approach this essential financial task.

As Fidelity houses my employer’s retirement accounts, Roth IRA, and brokerage accounts, I wanted my emergency fund there to shift money between accounts seamlessly. My strategy is making laddered investments in treasury bills (T-bills) backed by the U.S. government. T-bills are exempt from state and local taxes, but interest earned is fully taxable at the federal level. This should be an investment consideration based on which state you reside in.

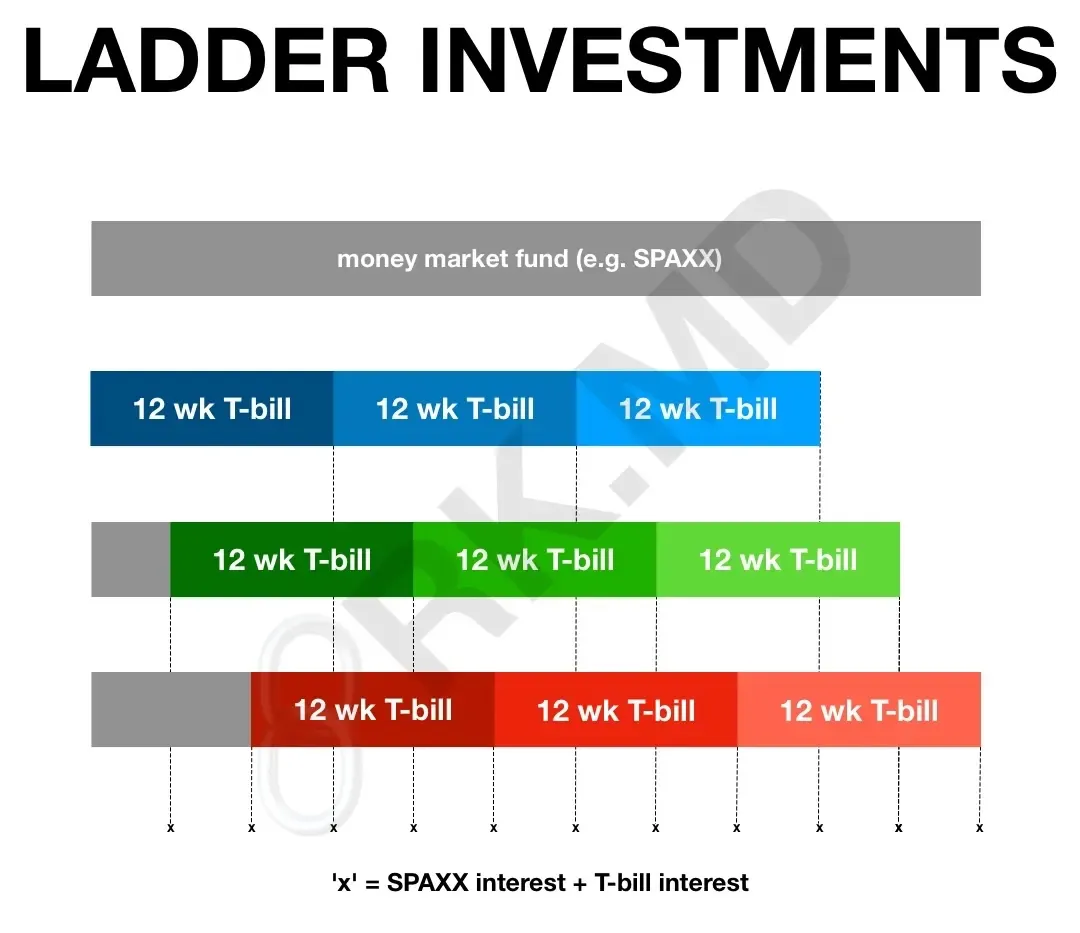

I’ve divided my emergency fund into four “ladder rungs” within a dedicated “Emergency” brokerage account.

- Liquid assets in Fidelity’s government money market fund (SPAXX) cover ~3 months of expenses with a 4.98% annualized yield at the time of this writing.

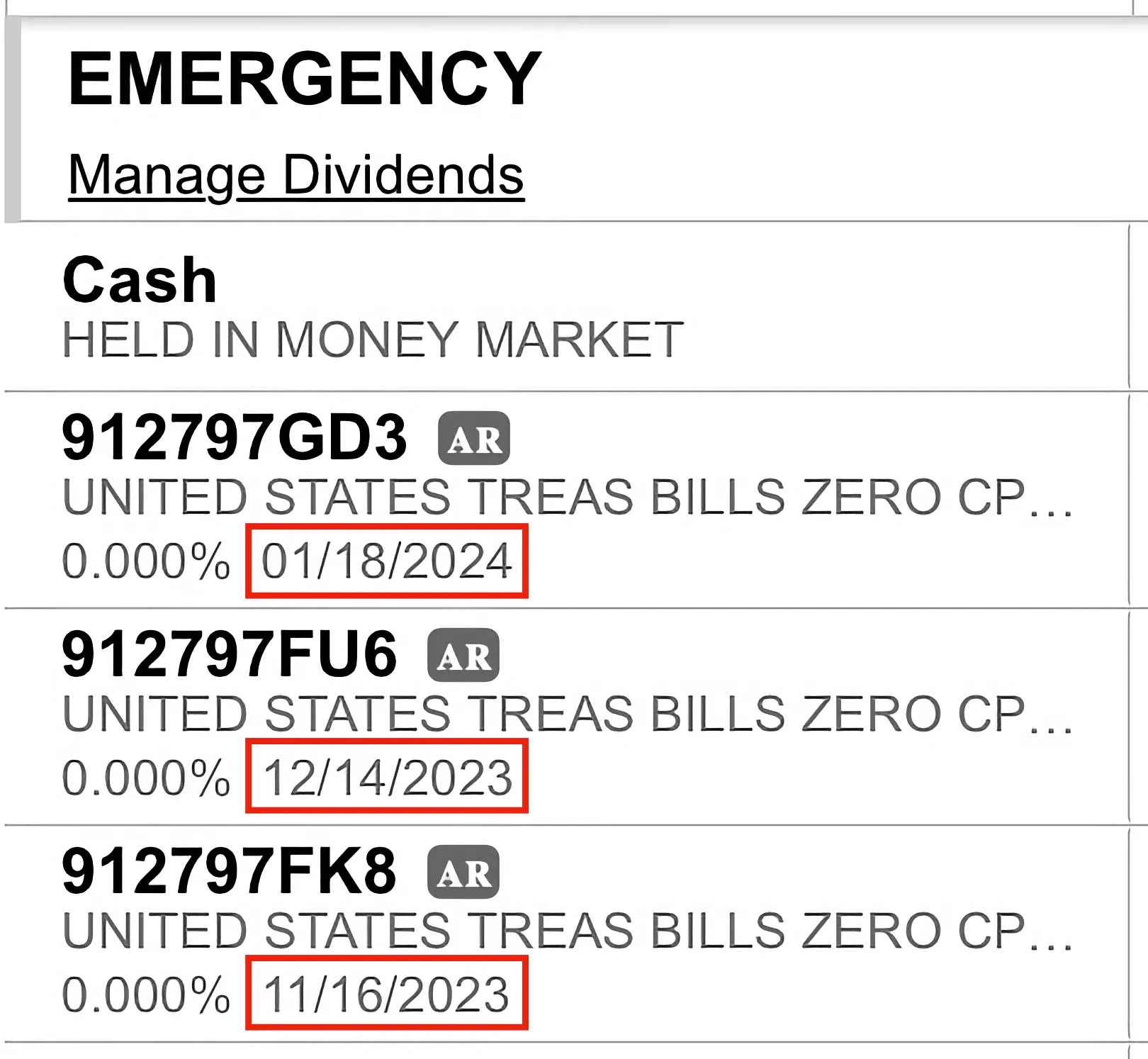

- The three remaining rungs are equal investments in T-bills which mature at ~4 weeks, ~8 weeks, and ~12 weeks from the day the emergency fund is created. In the image, the red boxes denote when each T-bill matures. At the time of maturation, the principal (plus accrued interest) will be automatically reinvested in comparable T-bills (the “AR” designation in the image above), which matures ~12 weeks from that day. The result is that every ~4 weeks, an investment will mature and give me the option of keeping it liquid as SPAXX versus reinvesting.

In the example above, one can see how the boxed maturation dates are staggered.

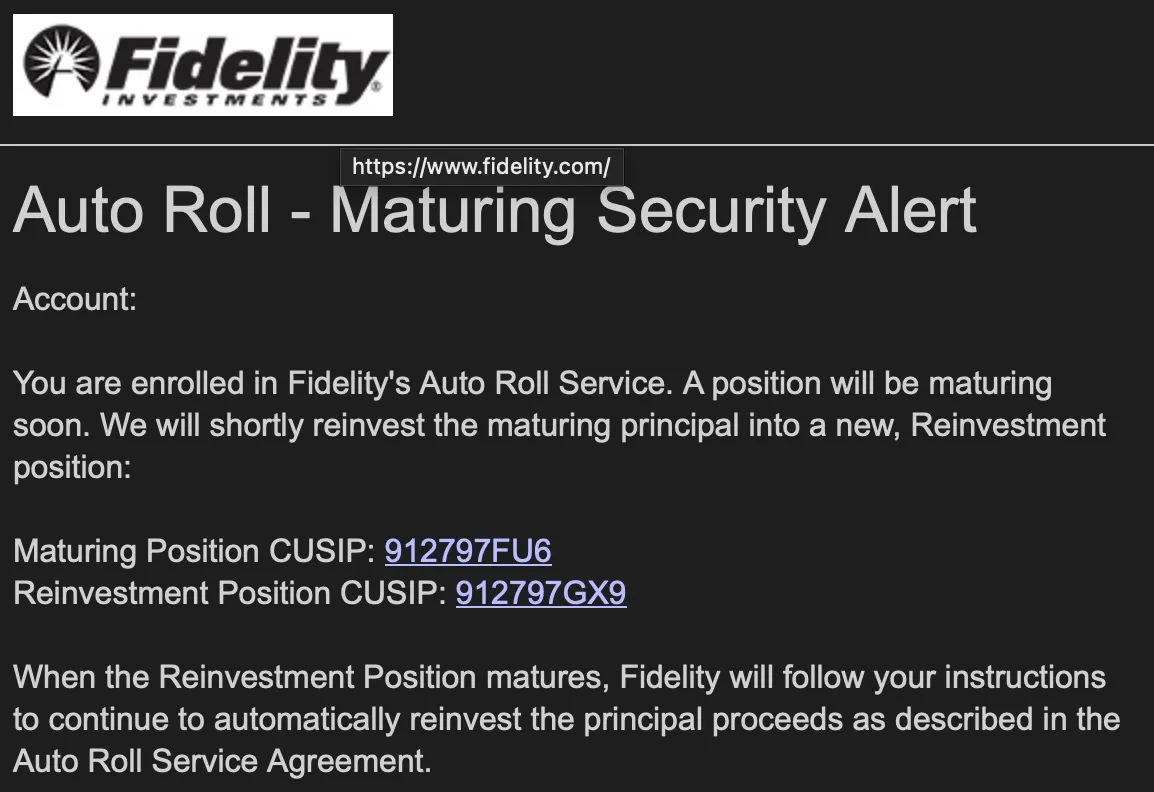

During the first week of every month, I get an email from Fidelity with what my maturing security will automatically reinvest in. I have the option to decline if I want.

Drop me a comment below with questions or tips regarding emergency funds!