One of the unfortunate aspects of physician training is that although we spend countless years and dollars learning how to become competent clinical decision-makers, there aren’t many lessons on financial management. As new attendings, we have “financial advisors” pitching us investment ideas and portfolio management with fees. We also have random people trying to “sue the rich doctor” for the most unexpected things. Therefore, it’s essential to take time some time to learn about investments, retirement, insurance, and other considerations early in one’s career as a physician. After all, no one will care about your assets more than you! In this post, I’ve outlined some items for consideration. Remember that these tips need to be modified based on your life circumstances.

This post was last updated on 2/21/2024.

STAY ORGANIZED

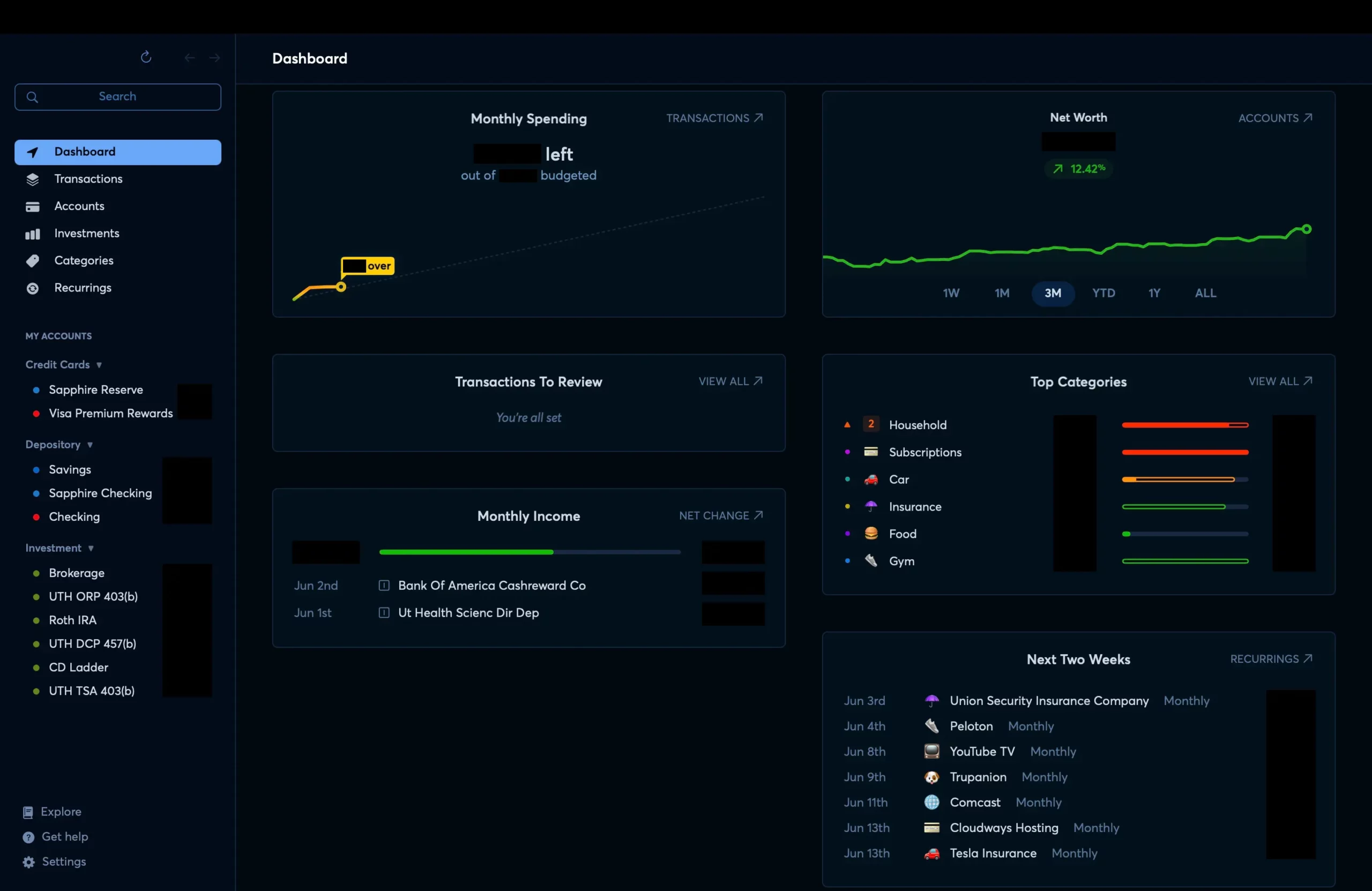

Soon after becoming an attending, I started using Empower (invitation link – we’ll both get $20 Amazon gift cards once you link retirement accounts!) as a digital means of tracking my net worth, income, investments, and expenses by syncing up with my bank account, credit card, and retirement accounts. I transitioned to Copilot for my iPhone and Mac (use my referral code 3WHDW8 for two months free). This has been an excellent way to see my investments, net worth, cash flow (income versus expenses), etc.

Finally, consolidate your accounts as much as possible. My primary checking account is a JPMorgan Chase Sapphire Checking account. I also have the following credit cards to maximize points:

- Chase Sapphire Reserve (referral link) for travel credit, Global Entry, Lyft, hotels, and dining

- Chase Ink Unlimited (referral link) for everything else

- Chase Freedom Flex (referral link) for the quarterly bonuses

- Bilt Rewards (referral link) card for rent

I aim to maximize my cents per point (CPP) when redeeming points where CPP = (cash cost – fees/taxes) / # points used

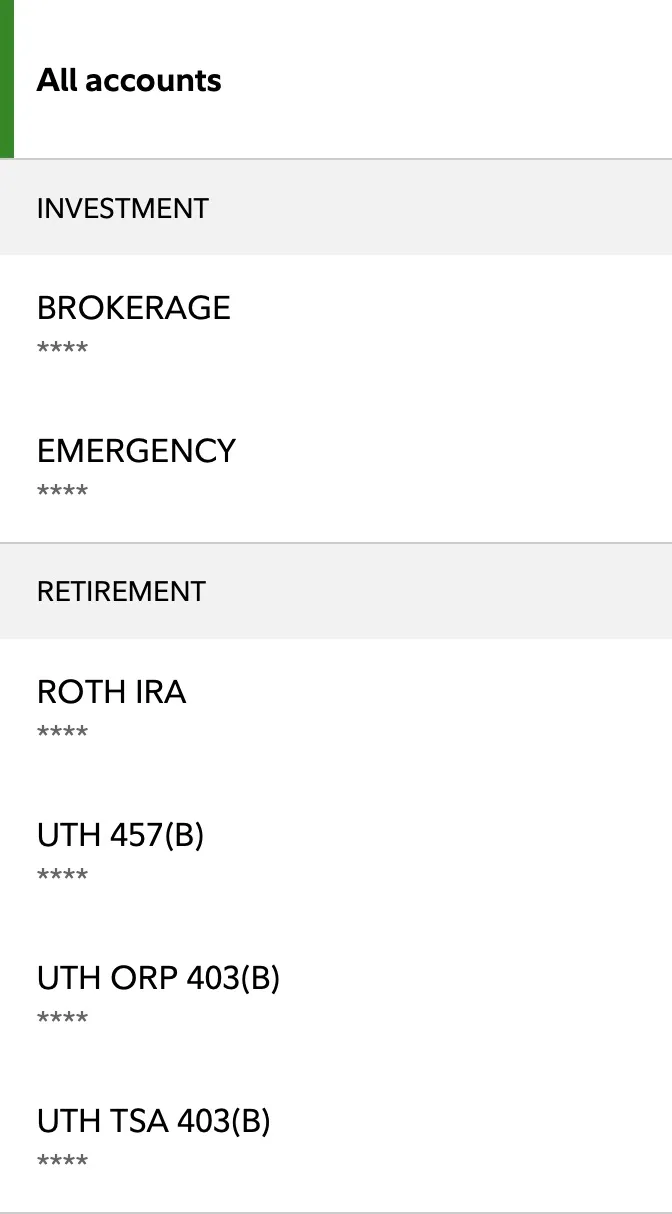

Fidelity houses over 99% of my net worth in retirement and brokerage accounts. All my accounts are linked, making shifting money from place to place easy. I also have a limited liability corporation (RK.MD LLC) for current and future projects.

BUDGET AND LIVE LIKE A RESIDENT

I moved back to Houston from Boston in mid-July 2019 but didn’t start working until October 1, 2019. After ten years of medical training, I took some “me time” to travel and purchase new furniture and technology; however, I chose to live in the same apartment (literally the same floor plan) that I did as a resident. I maximized my retirement contribution early, minimized unnecessary expenses, and focused on opportunities to save and invest early in my career.

When new gadgets are released, I’ll splurge a little, but I live well within my means for most of the year and seek opportunities to make more money by moonlighting in the OR and ICU. The general saying is to live like a resident until one’s student loans are paid off. I would also use that time to build up an emergency fund.

INSURANCE

You have to purchase auto insurance to cover the risk of financial liability in the event of an accident. It’s a fixed, yearly expense. So shop each year for the most affordable option to meet your needs.

Disability insurance is insurance for you if something terrible happens. If you depend on your monthly income for day-to-day expenses, you should consider disability coverage. Attendings are often enrolled in a relatively inexpensive group disability program by default. Therefore, it’s crucial to investigate specialty-specific options offered by Ameritas, Guardian, MassMutual, Principal, and The Standard. Policies typically pay till age 65 with a waiting period of 90 – 120 days. As a side point, if you are a resident or fellow, buy disability insurance before you become an attending (with a future increase rider)! It’ll work out much cheaper!

Furthermore, it’s important to investigate riders – options that can enhance coverage by customizing the policy to meet one’s needs. Some popular riders include residual disability, future increase, cost-of-living adjustment (COLA), student loan, etc. The Physician Philosopher and The White Coat Investor have excellent write-ups.

Life insurance is to help your dependents (kids, parents, spouse) and comes in two types:

- Term (cheaper): 10, 20, 30 year

- Whole life (don’t get this)

Many employers have some form of life insurance to enroll in (sometimes they require a medical exam, and sometimes they’re not portable). Depending on your needs, a separate policy might make sense. White Coat Investor has an excellent write-up on this.

Umbrella insurance extends the liability limits of existing insurance policies. Physicians tend to have umbrella policies of $1 million, $2 million, or $5 million. Bundling umbrella coverage with home and automotive insurance often results in better prices.

RETIREMENT & INVESTMENTS

It’s crucial to ensure the retirement program you’re enrolled in by default aligns with your career goals in the future. If other options permit more flexibility, consider switching early, as these decisions are often time-sensitive. For example, my default retirement program was the Teacher Retirement System of Texas (TRS); however, I opted to switch to the Optional Retirement Program (ORP) and did so within the first 90 days of employment.

It’s also worth looking at what securities your retirement contributions are purchasing. Often, it’s a target-date fund or a collection of securities that change over time to become more conservative as the target year for retirement approaches. Target-date funds offer a quick way to diversify assets across domestic stocks, bonds, and international stocks; however, expense ratios must be considered like all actively managed funds. Typically, I look for expense ratios < 0.2%, but if you’re interested, use an expense ratio fee calculator to estimate the impact this fee can have over years of growth.

“A low-cost index fund is the most sensible equity investment for the great majority of investors.”

Warren Buffett

Instead, many may opt for index funds that mirror market indices like the S&P 500 or Nasdaq. Index funds follow a defined number of stocks (e.g., the S&P 500 tracks the 500 largest companies in the US). The advantage is that there is no active management of these index funds, so the expense ratios are minimal. For example, my retirement accounts are through Fidelity, and I allocate most of my contributions to the Fidelity® 500 Index Fund (FXAIX, 0.015% expense ratio).

Additionally, open a Roth IRA. Compared to traditional “pre-tax” retirement accounts, where you will be taxed when you start withdrawing funds at retirement, a Roth IRA grows over time and allows you to withdraw funds tax-free at 59½ years old.

As a resident/fellow, you can contribute a maximum of $7,000 per year at this time; however, your modified adjusted gross income (MAGI) is likely above the contribution limit as an attending physician. Fear not – you can always contribute to a traditional IRA and perform a Roth conversion (“backdoor Roth IRA“), knowing that you or your accountant must complete tax form 8606.

Like a Roth IRA using post-tax dollars, a 529 plan is designed to promote savings for your children’s education costs. Each parent can contribute $15,000 per child yearly and even start five years beforehand. For example, a newborn could already have $15,000 x 2 parents x 5 years = $150,000 in savings. The designee of a 529 can be changed from one child to another, and $10,000 per year can be used for private secondary education.

Finally, create a brokerage account. This is a more traditional account where I’ll contribute and invest in low-expense ratio exchange-traded index funds (ETF) like Vanguard Total Stock Market ETF (VTI) and Vanguard Total International Stock ETF (VXUS) each week. This allows for vast diversification across the American and international markets.

I hold onto these funds for at least a year, so whatever earnings I make, I’ll pay the much lower long-term capital gains tax than short-term capital gains tax.

Other options include certificates of deposit (CD) and treasury bills (“T-bills“). Both options offer safe, predictable returns but at the cost of liquidity. Once the money is invested in a CD or T-bill, it remains locked until the maturity date, which could range from one month to several years, depending on your purchase. Withdrawing early results in penalties. Furthermore, unlike CDs, one does not pay state tax on the capital gains generated by T-bills. My emergency fund is comprised of laddered T-bills.

In summary:

- Save 20% of pre-tax income for retirement.

- Max out any retirement accounts where you receive employer matching (e.g., 401K/403b)

- Consider investing in other retirement accounts your employer offers (e.g., 457 deferred compensation)

- Max your Roth IRA

- Create a brokerage account

- Create 529 plans for children

- Create a diversified portfolio – S&P 500 index funds are an easy way to do this.

- Focus on paying off the principal on student loans and mortgages

- Create a six-month emergency fund

I’m still learning about navigating these areas, so please comment with questions or your own experiences and thoughts! 🙂